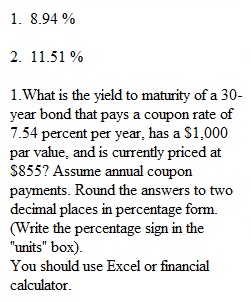

Q 1.What is the yield to maturity of a 30-year bond that pays a coupon rate of 7.54 percent per year, has a $1,000 par value, and is currently priced at $855? Assume annual coupon payments. Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box). You should use Excel or financial calculator. 2.Blue Crab, Inc. plans to issue new bonds, but is uncertain how the market would set the yield to maturity. The bonds would be 11-year to maturity, carry a 8.77 percent annual coupon, and have a $1,000 par value. Blue Crab, Inc. has determined that these bonds would sell for $834 each. What is the yield to maturity for these bonds? Round the answers to two decimal places in percentage form. (Write the percentage sign in the "units" box). You should use Excel or financial calculator. 3.Fresh Fruit, Inc. has a $1,000 par value bond that is currently selling for $1,459. It has an annual coupon rate of 16.33 percent, paid semiannually, and has 18-years remaining until maturity. What would the annual yield to maturity be on the bond if you purchased the bond today and held it until maturity? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) You should use Excel or financial calculator. 4.A few years ago, Spider Web, Inc. issued bonds with a 10.23 percent annual coupon rate, paid semiannually. The bonds have a par value of $1,000, a current price of $937, and will mature in 8 years. What would the annual yield to maturity be on the bond if you purchased the bond today? Round the answer to two decimal places in percentage form. (Write the percentage sign in the "units" box) You should use Excel or financial calculator.

View Related Questions